F&O Strategy: Buy Adani Energy call

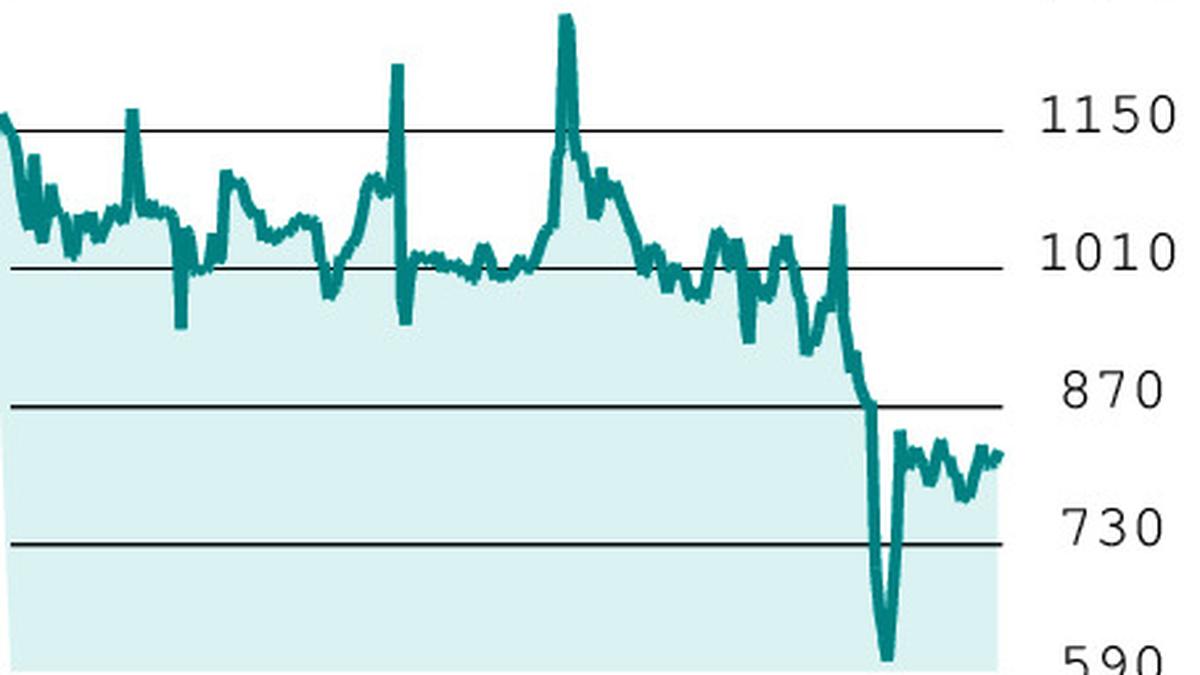

For the stock of Adani Energy Solutions (₹821.25), the short-term outlook turned positive after a recent bounce. Immediate support levels are at ₹793 and ₹697. A conclusive close below the latter will alter the short-term positive view.

Nearest resistance is at ₹842. A close above this has the potential to lift Adani Energy Solutions towards ₹940. In the short term, we expect the stock to move in a narrow range with positive bias.

F&O pointers: Adani Energy Solutions Jan futures closed at ₹824.60 against the spot price of ₹821.25. Build-up in open positions suggests accumulation of long positions. Option trading indicates that the stock could move in the ₹800-900 range.

Strategy: Consider buying 840-strike call on Adani Energy Solutions. The option closed with a premium of ₹26.95. As the market lot is 625 shares, this strategy would cost ₹16,843.75, which would be the maximum loss. That would happen if the stock fails to cross ₹840 on expiry. The break-even point would be ₹866.95.

Hold the position for at least two weeks. While initial stop-loss can be placed at ₹14, it can be shifted to ₹26 if the stock opens on a positive note on Monday. Stop-loss can be shifted to ₹28 when the premium moves to ₹32. Aim for a target of ₹40.

As Adani group stocks are volatile in nature, we advise traders to follow strict stop-loss to cut losses/protect profits.

Note: The recommendations are based on technical analysis and F&O positions. There is a risk of loss in trading.