F&O Query: Should You Hold the Longs on Axis Bank Call Options?

I’m holding two lots of Axis Bank 1180-call options. Average buy price is ₹21. Should I hold or exit the trade?

Vivek S

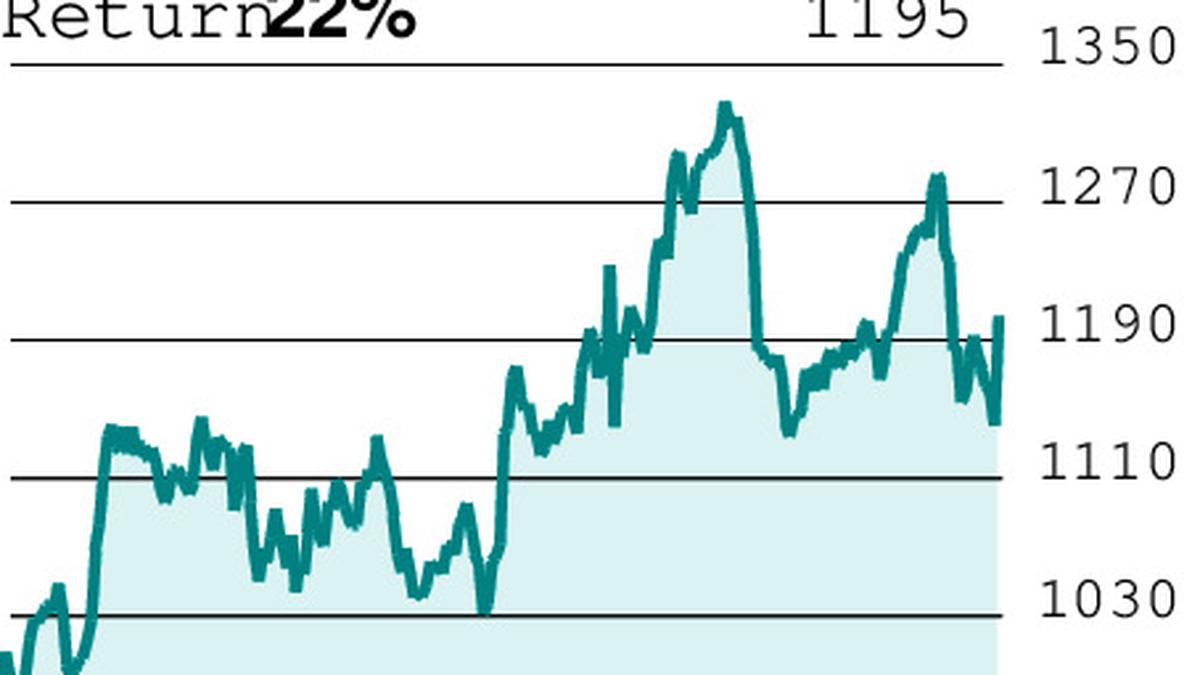

Axis Bank (₹1,196.9): The stock of Axis Bank bounced off the support at ₹1,130 last week. It witnessed a sharp rally on Friday, which led to the scrip moving above a key level at ₹1,185, a bullish indication.

Note that a close above ₹1,185 has confirmed a double-bottom pattern on the daily chart. This set up hints at a potential bullish reversal in trend. As per this, the price is set to increase to ₹1,250 in the short run.

Although there is a chance for the price to see some moderation from the current level, a decline below ₹1,170 is less likely.

Overall, given the prevailing price action, there is a good chance for the stock to touch ₹1,250 in the short-term.

The 1180-strike call option’s premium closed at ₹27.85 on Friday. If the share price of the underlying stock rises to ₹1,250 in a week, the option price is likely to touch ₹60.

Considering the above factors, we suggest holding your position. But place a stop-loss at ₹10. When the option premium appreciates to ₹40, revise the stop-loss to ₹25 to secure a part of your profits. Liquidate the trade when the price of the option hits ₹50.

You may consider buying call options again if the stock breaks out of ₹1,250. Because this can possibly lift the scrip to ₹1,320.

That said, instead of the October series, our suggestion would be to go for the November 1250-strike call so that you will have more time for the potential upside to ₹1,320 play out.

Send your queries to [email protected]