F&O Query: Should You Hold Sun Pharma Call Option?

I bought three lots of Sun Pharmaceutical 1860-call option (January) at an average premium of ₹60.78. Should I hold for another 2-3 weeks or exit now? – Anish Das

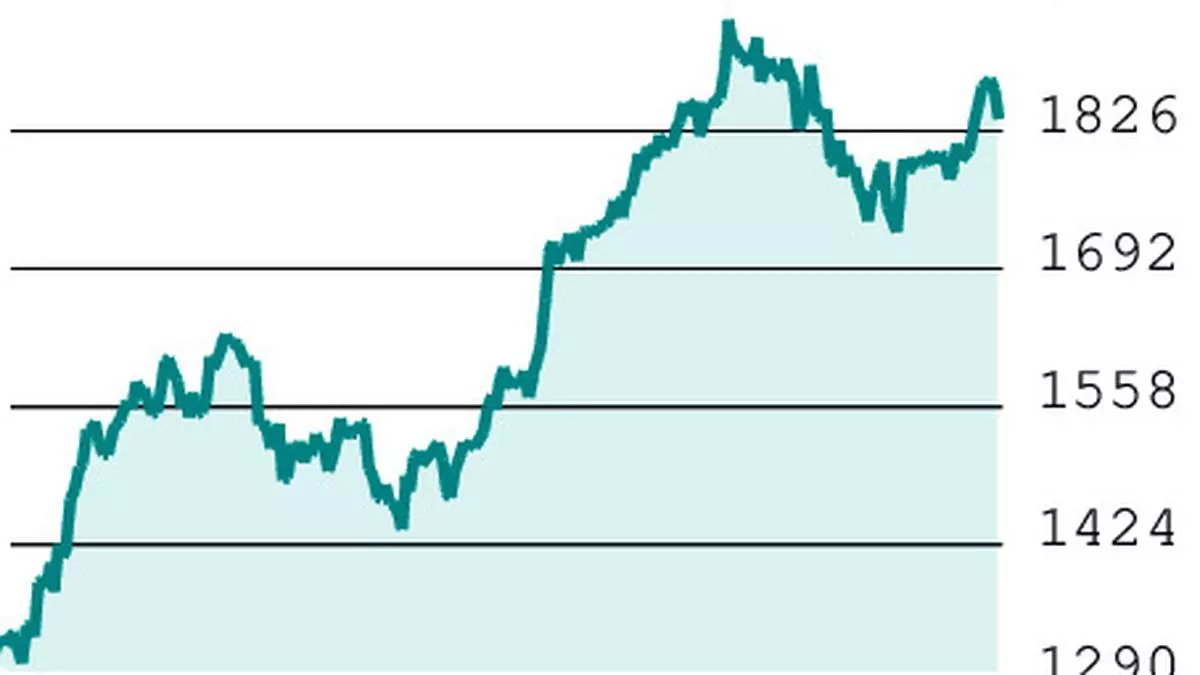

Sun Pharmaceutical Industries (₹1,849.65): The stock broke out of the resistance at ₹1,830 in the final week of December. Technically, this served as an indication that the scrip has resumed the broader uptrend after some moderation in price in the preceding few weeks.

After touching ₹1,910 on Dec 31, the price softened and the stock closed at ₹1,849.65 on Friday. But it managed to stay above the resistance-turned-support of ₹1,830. The 20-day moving average and a rising trendline coincide at this level, making the support strong.

So, the stock is likely to resume the uptrend from the current level or after a dip to ₹1,830. In such a case, in the near-term, Sun Pharma’s share price can touch ₹1,950.

If the stock appreciates to ₹1,950 before one week of the expiration of January derivative contracts, the premium of 1860-call (₹32.6) can rise to ₹90. In case the underlying stock’s price moves up to ₹1,950 two weeks before expiry i.e., by mid-Jan, the option price can hit ₹100.

Considering the above factors, we suggest holding the call option that you bought. Rather than exiting all three lots at one price point, you can liquidate one lot each at ₹80, ₹85 and ₹90. We also suggest you keep a stop-loss at ₹38, when the option premium increases to ₹60.

On the other hand, if the stock breaches the support at ₹1,830, the outlook for the near-term can turn uncertain. So, exit the option at the prevailing price when Sun Pharma’s share price slips below ₹1,830.

Also, there is a possibility that the stock hits neither ₹1,950 nor ₹1,830. In this scenario, the option premium can drop due to time decay. Here, you can have a stop-loss at some price level based on your risk tolerance and exit. Our suggestion would be not to hold this trade beyond January 20.

Send your queries to [email protected]