F&O Query: Should You Buy Put Options on Escorts Kubota?

Escorts Kubota is forming a head and shoulder pattern. Can I buy a put option?

Muthukumar

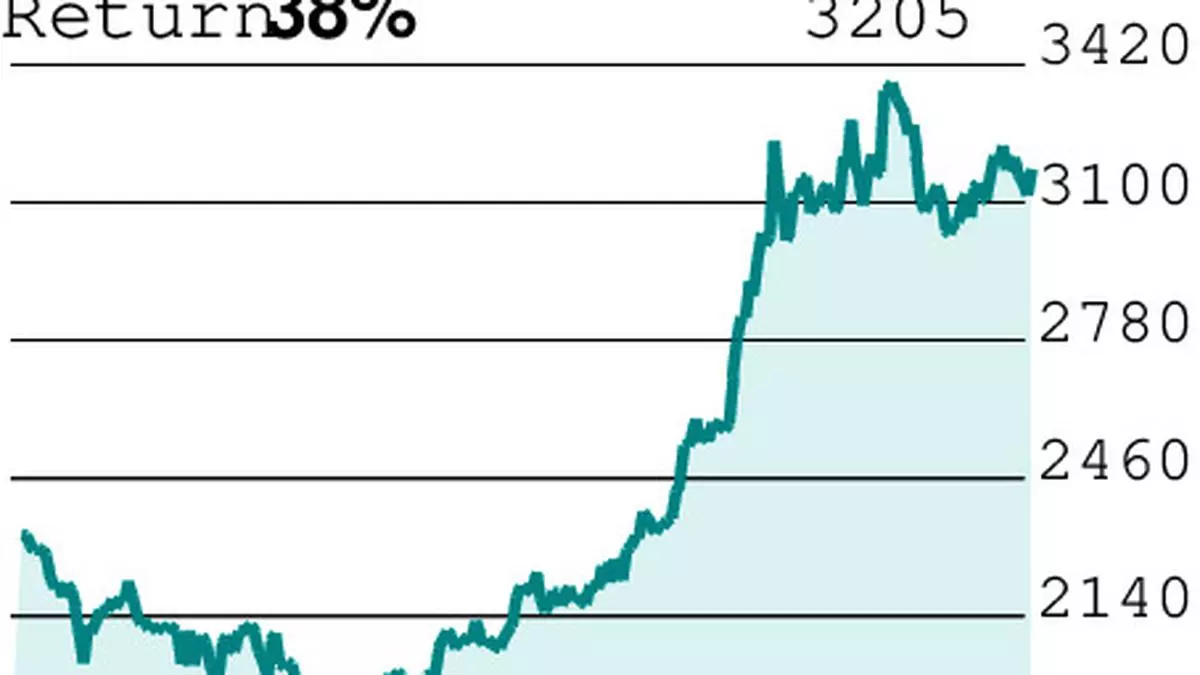

Escorts Kubota (₹3,205.2): The stock has largely been moving in a sideways trend since September. It has been held between ₹3,000 and ₹3,450 for the past three months.

The daily chart shows that Escorts Kubota is in the process of forming a head and shoulder (H&S) pattern. As it stands, the pattern is not confirmed, and we cannot be certain that it will happen. So, buying a put option at this juncture is not ideal.

Instead, you can consider a short strangle options strategy if you are comfortable with the margin obligations. Since the stock of Escorts Kubota continues to chart a sideways trend, executing short strangle can be beneficial.

Implement this strategy by simultaneously selling 3450-call and 3000-strike put options. These options closed at ₹37.10 and ₹26.05 respectively on Friday. So, selling one lot each can result in you receiving ₹63.15 as premium. Since the market lot of this stock is 275 shares, ₹63.15 premium means an inflow of ₹17,366.25.

Hold both these options until expiry. But here is the exit plan should Escorts Kubota’s stock move out of the range. If it breaks out of the resistance at ₹3,450, exit the short position on 3450-call and continue to hold 3000-put short until expiry.

On the other hand, if the stock slips below the support at ₹3,000, it will confirm the H&S pattern. According to this, a break of ₹3,000 can lead to a fall to ₹2,550. So, if Escorts Kubota’s share price slips below ₹3,000, exit short strangle — liquidate both 3450-call and 3000-put short position.

After exiting the shorts, you can consider buying either 3000- or 2900-strike put options. Decide between these two strikes based on the option premium and your risk appetite. Exit this when the option price doubles.

Consider December expiry puts if the breach of the support at ₹3,000 happens in the first half of this month. In case the stock breaks the support in the second half of December, we advise to go for January puts so that you can avoid time decay to a large extent.

Send your queries to [email protected]