Five-Star Business Finance Q2 Results: Posts ₹268 cr profit, AUM grows 32%

Five-Star Business Finance Ltd reported robust double-digit growth in net profit for the second consecutive quarter, alongside a significant increase in its assets under management (AUM).

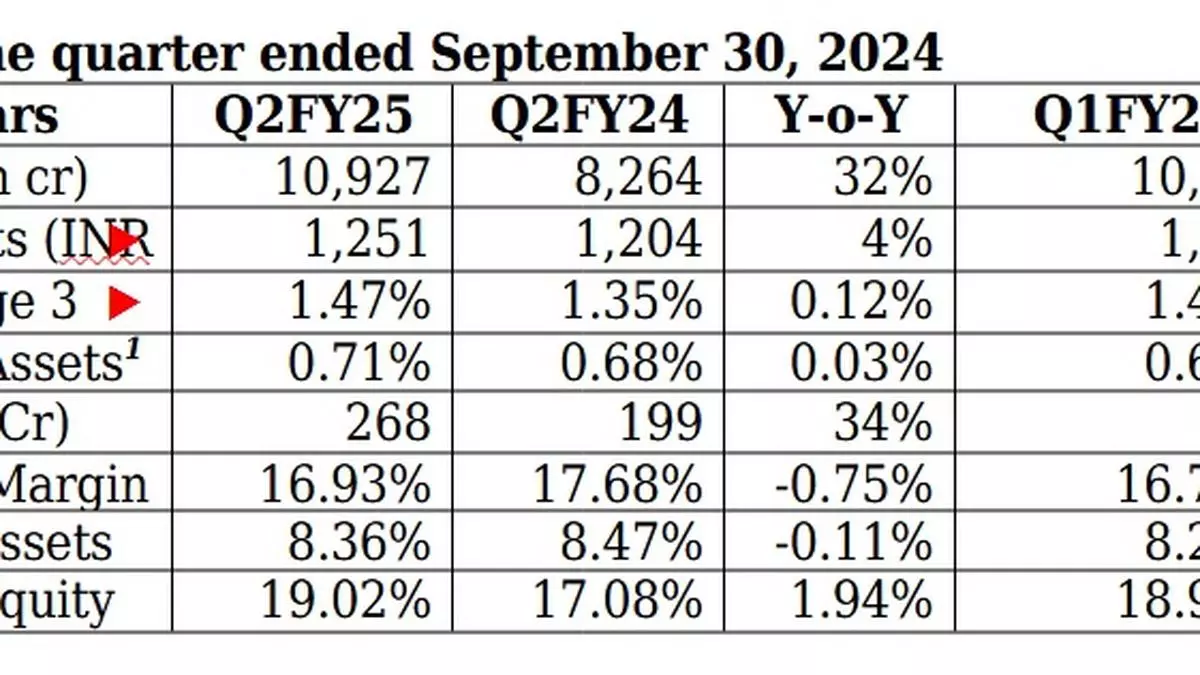

For the quarter ended September 30, 2024, the company’s net profit surged by 34per cent to ₹268 crore, up from ₹199 crore in the same quarter last year, driven by higher net interest income.

Total income grew by 35per cent to ₹706 crore in the September quarter, when compared with ₹522 crore a year earlier, while net interest income rose 30per cent at ₹543 crore as against ₹416.5 crore.

Assets under management

The company’s AUM saw a 32per cent increase to ₹10,927 crore in Q2 FY2025, from ₹8,264 crore in the same period last year. On a sequential basis, AUM grew by 6per cent, according to a statement.

“We had a strong Q2, despite sectoral challenges, particularly those affecting unsecured lenders. Our fully secured lending model, combined with strong underwriting and collections processes, has enabled Five-Star to deliver strong results this quarter,” said Lakshmipathy Deenadayalan, Chairman and Managing Director of Five-Star Business Finance.

- Also read: Kirloskar Brothers Q2 consolidated PAT up 90%, consolidated revenue from operations up 13.4%

The company disbursed loans worth ₹1,251 crore in Q2 FY2025, slightly down from ₹1,318 crore in the previous quarter but up from ₹1,204 crore in Q2 FY2024. “This reflects a deliberate strategy to moderate portfolio growth for the full year, resulting in a slight quarter-on-quarter decline in disbursements, but a 4per cent year-on-year increase,” he added.

Despite headwinds, the company’s collection efficiency stood at 97per cent, a marginal drop from the previous quarter, while overall collection efficiency was 98.4per cent. As a result, gross non-performing assets (NPA) saw a slight increase of 6 basis points, from 1.41per cent in Q1 FY2025 to 1.47per cent in Q2. The 30+ delinquency rate in Q2 FY2025 was 8.44per cent.

During the quarter, Five-Star secured incremental debt sanctions of ₹420 crore and raised ₹575 crore. The cost of funds remained steady at 9.65per cent. The company maintained liquidity of ₹1,699 crore on its balance sheet, along with unavailed sanctions of ₹245 crore.

Five-Star also expanded its footprint, adding 113 branches in Q2 FY2025, taking the total number to 660 branches across 10 States and one union territory. Its workforce grew to 10,366 as of September 2024, up from 8,261 a year ago.