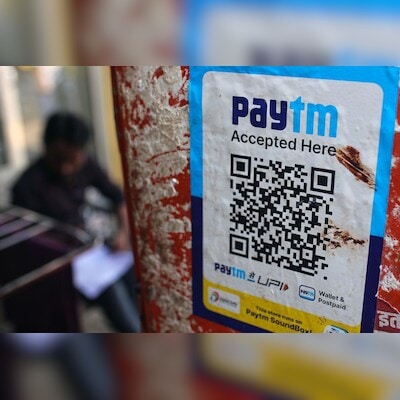

Crisis-hit Paytm woos merchants with health plan at Rs 35 a month

The plan also offers income protection cover in case of accidental injuries and natural calamities. (Image: Bloomberg)

Paytm Health Saathi can be availed of on the ‘Paytm for Business’ app, the company said in a filing. In a bid to strengthen its merchant ecosystem, the company is offering health care benefits such as consultations with doctors over telephone and in-person doctor visits (OPD) within partner networks.

The plan also offers income protection cover in case of accidental injuries and natural calamities through partners, the statement read.

Details of Paytm’s healthcare plan for merchants:

1) Paytm’s healthplan starts at Rs 35 per month on a subscription basis, in which the doctor teleconsultation service will be powered by MediBuddy. The merchant partners can avail additional benefits such as discounts at leading pharmacies and on diagnostic tests.

2) Paytm said that the claim process for the services can be completed within the mobile application in a bid to ensure easy access for the partners.

3) According to the company, the pilot phase of the plan launched in May, has seen 3,000 merchant partners onboard. Subsequently, it decided to roll out the plan to all of its merchant partners.

Paytm witnesses slowdown in business after RBI action

The Noida-based fintech major is reeling under a crisis since the Reserve Bank of India (RBI) in January imposed regulatory curbs on its affiliated business – Paytm Payments Banks.

Due to the RBI’s action, the company has witnessed a slowdown in its core business of merchant payments and consumer lending. According to the company’s filing in May, its monthly transaction consumer base shrank 24 per cent to 80 million in April compared to January.

The count of active devices used by merchants dropped about 1 million, the company said. These include point-of-sale (PoS) and QR code machines.

“In Q4 FY2024, revenue from financial services and others declined 36 per cent year-on-year to Rs 304 crore on account of lower loan distribution,” the company said.

Till September 2023, Paytm had 38 million merchants on its platform, which it is scrambling to save as rival players such as GooglePay and PhonePay are seeking to poach these merchants.

First Published: Jul 03 2024 | 11:39 AM IST