Categorise Indian rice as ‘speciality’ and ‘common’ varieties, say traders, exporters

With the Centre banning exports of white rice and non-resident Indians, mainly from the South, looking to get their favourite Sona Masuri or Ponni rice variety, the Centre’s policy of classifying the cereal as basmati and non-basmati has come under scrutiny.

One of the arguments put forth to change the classification from Basmati and non-Basmati is that some of these rice varieties, including Red rice or Matta, Idly rice, Kichili Samba, Navara, Gobindobhog, all are priced higher and some of them fetch even higher rates than basmati.

“The usage of basmati and non-basmati is discriminatory against other special varieties. Instead, the Government should use speciality and common rice terms,” said S Chandrasekaran, a Delhi-based analyst and consultant with the Centre for agricultural trade.

‘Fix floor price’

“It will take time for the Government to realise the value of speciality rice. Customs authorities too are finding it difficult to distinguish. We definitely need different nomenclature to recognise speciality rice,” said BV Krishna Rao, President, The Rice Exporters Association (TREA).

Earlier this week, TREA wrote to Commerce Minister Piyush Goyal to have a different harmonised system of nomenclature (HSN) code for rice varieties such as Sona Masuri. “In view of the difficulties, we are urging the Government to fix a minimum export price (MEP) for these varieties,” he said.

“The Government should classify specialty rice through special HSN code, particularly for Sona Masuri, Matta and Gobindobhog that expats consume,” said Rajesh Jain Paharia, a Delhi-based exporter.

Data pointers

This will help in supplies of these rice varieties flowing freely, while setting a MEP of $1,000/tonne will also help, he said. “This will prevent them from switching over Japonica or Camolino rice,” Jain said.

M Madan Prakash, President, Agri Commodities Exporters Association, agreed with classifying speciality varieties. “These rice varieties are consumed only by a specific group of consumers such as non-resident Indians. The common variety is consumed by people in South-East Asia and Africa,” he said.

Will India’s ban on non-Basmati rice exports trigger global food inflation?

Will India’s ban on non-Basmati rice exports trigger global food inflation?

VR Vidyasagar, Director, Bulk Logix, said no one is sure about the Government’s thought.

Chandrasekaran said data available on rice exports from Sona Masuri to Ponni to traditional varieties are pointers that the Centre should drop classifying rice as Basmati and non-Basmati,” said.

As shipments were stabilising…

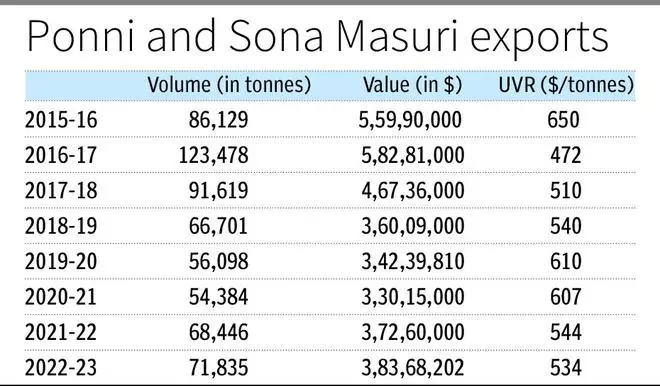

In fact, the ban came at a time when shipments of Sona Masuri and Ponni, two special varieties grown in South India, were stabilising after dropping from a high of 1.23 lakh tonnes in 2016-17,

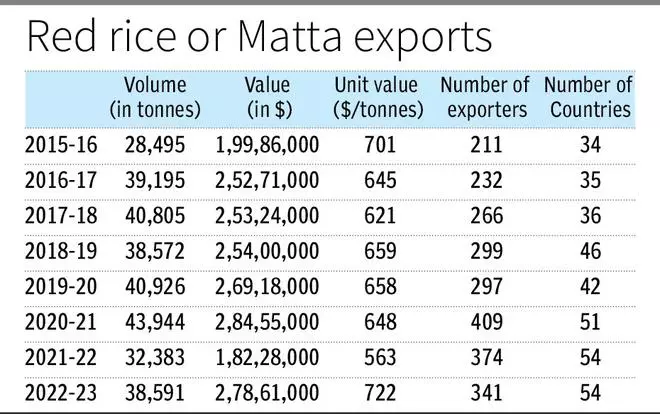

Similarly, data made available to businessline show that exports of red or Matta and Idly rice were finding their feet when the Centre banned exports of white rice on July 20 this year. Though Idly rice is not white rice, Customs authorities treat it as part of white rice since it is “boiled” only once.

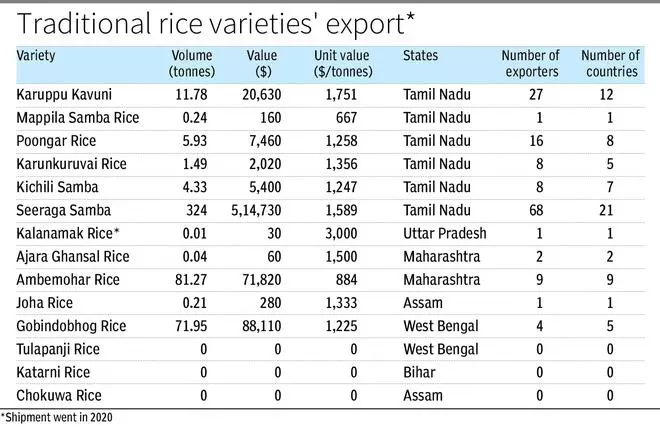

Data show that geographical indications rice varieties such as Wayanadan Gandhakasala and Jeerakasala or Navara or Joha or Gobindobhog have all fetched over $1,250 a tonne in the global market.

Again, traditional varieties of rice mainly from Tamil Nadu such as Karuppu Kavani, Poongar rice, Kichili Samba and Seeraga Samba have fetched over $1,000 a tonne in the global market. In comparison, basmati rice fetched an average $1,050 a tonne last fiscal, data from the Agricultural and Processed Food Products Export Development Authority.

Returns on GI rice

Data show that India stands to gain by treating Sona Masuri or Ponni or Matta or other such varieties since they have always been priced above $500 a tonne since 2015-16.

For example, barring 2016-17 when Sona Masuri and Ponni rice fetched a unit value of $472 a tonne, they have always fetched over $510.

In the case of matta, except for 2021-22 when prices dropped to $563 a tonne, the red rice has always fetched nearly $625 since 2015-16. In the case of Idly rice, it has fetched a low of $485 a tonne in 2017-18 and $502 in 2016-17 and for the rest of the period prices have ruled above $525.

With regard to geographical indication rice, India fetched premium prices ranging from $3,000 a tonne for Kalanamak rice, $2,844 for Wayanad Gandhakasala rice and $12,916 for Wayanad Jeerakasala rice.

In the case of traditional varieties grown in Tamil Nadu, Karuppu Kavani fetched $1,751 a tonne and Seeraga Samba $1,589.