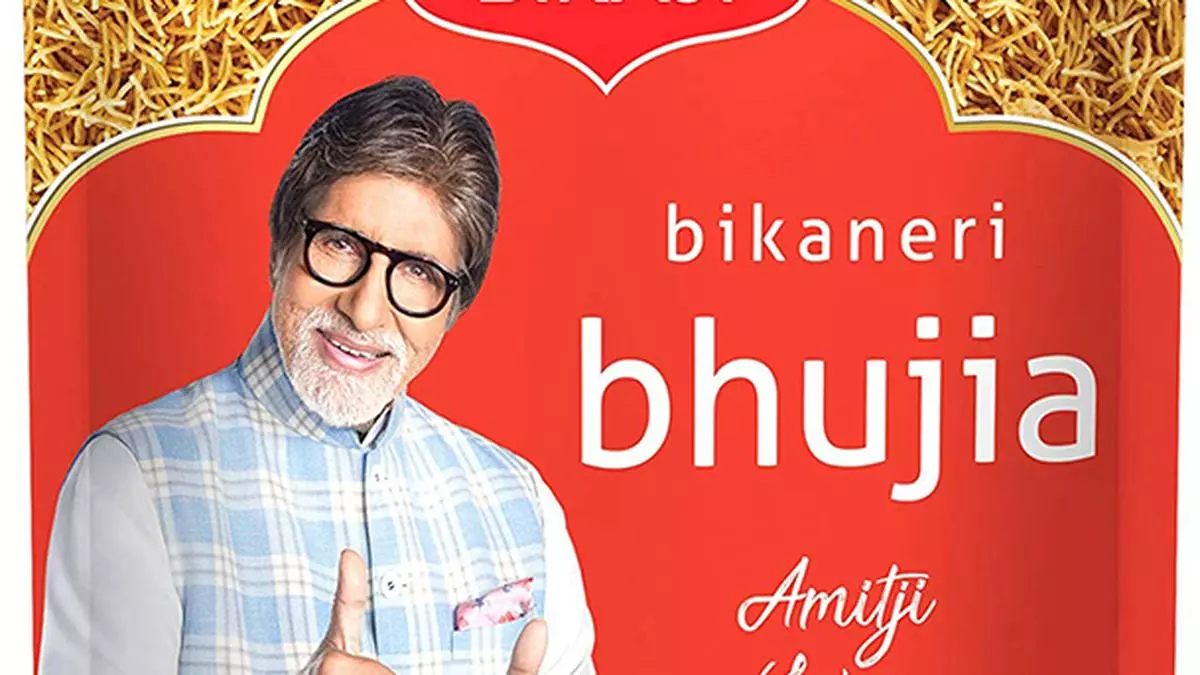

Broker’s Call: Bikaji Food International (Buy)

Target: 440 rupees

CMP: INR 380.60

Bakaji’s earnings reading for the fourth quarter of fiscal 2013 sharply beat estimates, as the loss in revenue was offset by a significant expansion in gross margins. Revenue growth performance was 4 percent lower than our estimate, primarily due to some weakness in demand seen in the early part of the quarter, which eventually rebounded in March.

The growth was primarily driven by volumes (low double-digit growth) during the quarter. In terms of segment performance, ethnic snacks (Bahojieh and Namkin) and packaged snacks in double digits Western Snacks delivered a strong performance growing more than 30 percent in the quarter, while Babad The performance was relatively poor, with sales growing in high single digits. t

Input prices are usually low due to the new crop season from December to February and the same is likely to see some upside in the coming months. While some of those gains may be reinvested back into the business to drive volume growth, we believe EBITDA margins in FY24 (ex-PLI incentive) will continue to improve over FY23.

Bakaji has strategically added new facilities to increase its manufacturing capabilities, which would help it improve direct access to core markets, and expand its presence in concentrated markets. With the favorable raw material scenario, the utilization levels and capital expenditure are greatly improved; Profitability, return metrics and cash flow generation are expected to improve.