Bitcoin’s tale of success sans substance

‘I told you so’ was the look every crypto bull had as Bitcoin briefly topped $100,000 last week, pushing the value of total Bitcoins mined to nearly $2 trillion!

The value of all the gold mined in the around 5,000 years of its recorded history is around $20 trillion.

Further it took around two decades and world-changing innovations since founding for companies like Amazon and Alphabet to cross a market-cap of $2 trillion.

It took even more for companies like Apple, Microsoft and Nvidia. But Bitcoin has achieved this feat in just about 15 years from the time the first Bitcoin was mined in 2009.

The problem though, as compared to other wealth creators like gold or the Big Tech corporations, is that Bitcoin is yet to prove any real use case for the masses and remains shrouded in lack of substance.

What is it, really?

Specifically doing the rounds in social media last week was a comment by Chris Dixon, a General Partner in well-known VC firm Andreesen Horowitz, as far back as in 2014 that Bitcoin could be worth $100,000. Back then Bitcoin was trading at a little above $800.

Quite some ‘Paul the Octopus’ level foresight one could say. But what is missed here is that his prediction was based on Bitcoin becoming the primary means of making payments on the internet.

Today, Bitcoin is anything but that. Common man or woman is still totally untouched by Bitcoin. With just around 11 million monthly active Bitcoin users (measured by the monthly active crypto addresses), per recent report by Andreessen Horowitz, one could say almost the entire world is not even remotely using Bitcoin to make payments/transact on the internet, maybe except for a small ecosystem that also includes criminals.

This is unlike any other true innovation of the past 15-year time horizon. For example, within 15 years of the internet being introduced to the public, there were over 1.5 billion active users.

This gives rise to the question: What purpose does Bitcoin actually serve? Is it a currency/store of value, a technological innovation for payments, a speculators’ nirvana or all of these?

Speculation is rife

Looking into the details, its utility and use case as a currency or a store of value is still not proven convincingly given its high volatility and the meagre adoption, but it has witnessed an unprecedented FOMO and speculative frenzy.

In less than a year since the first Bitcoin ETF was launched in the US in January this year, the current Bitcoin ETFs (which number to over 25) hold more than 5.5 per cent of total Bitcoins mined, with an AUM of over $110 billion!.

Some of them are leveraged ETFs. Leveraged ETFs used debt and derivatives to amplify returns.

For example, an ETF that aims to double returns will borrow the equivalent of each unit sold to customer to invest in assets like Bitcoin and double the daily returns.

This works other way also when Bitcoin declines, thereby significantly increasing volatility.

Further the speculation ecosystem has spread beyond ETFs to Bitcoin proxies like erstwhile software company MicroStrategy (MSTR) which has in recent years positioned itself as a Bitcoin Treasury Company by accumulating the cryptos from capital raised through equity and debt issuances.

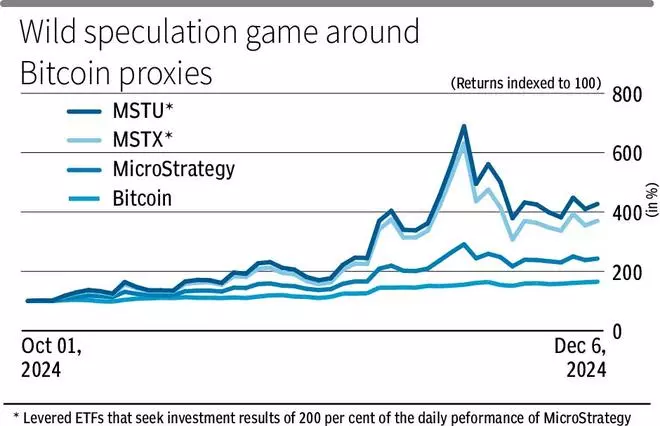

The Bitcoin FOMO spirit is best reflected in the stock of MSTR trading at 132 per cent premium to its Bitcoin NAV. With YTD returns of nearly 600 per cent, it is the best performing US large-cap stock. And to add to it, there are two levered ETFs (MSTU and MSTX) with AUM of over $2 billion each, purely tracking MSTR!

Given these, the speculation involving Bitcoin is undeniable. Steve Eisman, one of the famous Big Short investors in an interview to Bloomberg few months back, termed Bitcoin as just ‘another way to speculate on speculating.’

While the recent Trump win may have given huge boost to Bitcoin and fuelled this speculation, its true worth will be revealed during the time of the next global liquidity event.

Unlike gold, which has always shone as store of value during such events, Bitcoin is yet to prove the case.

Investors need to be clear that they are speculating and not investing when it comes to Bitcoin.