Bhavish Aggarwal’s AI startup Krutrim turns unicorn after raising $50 mn

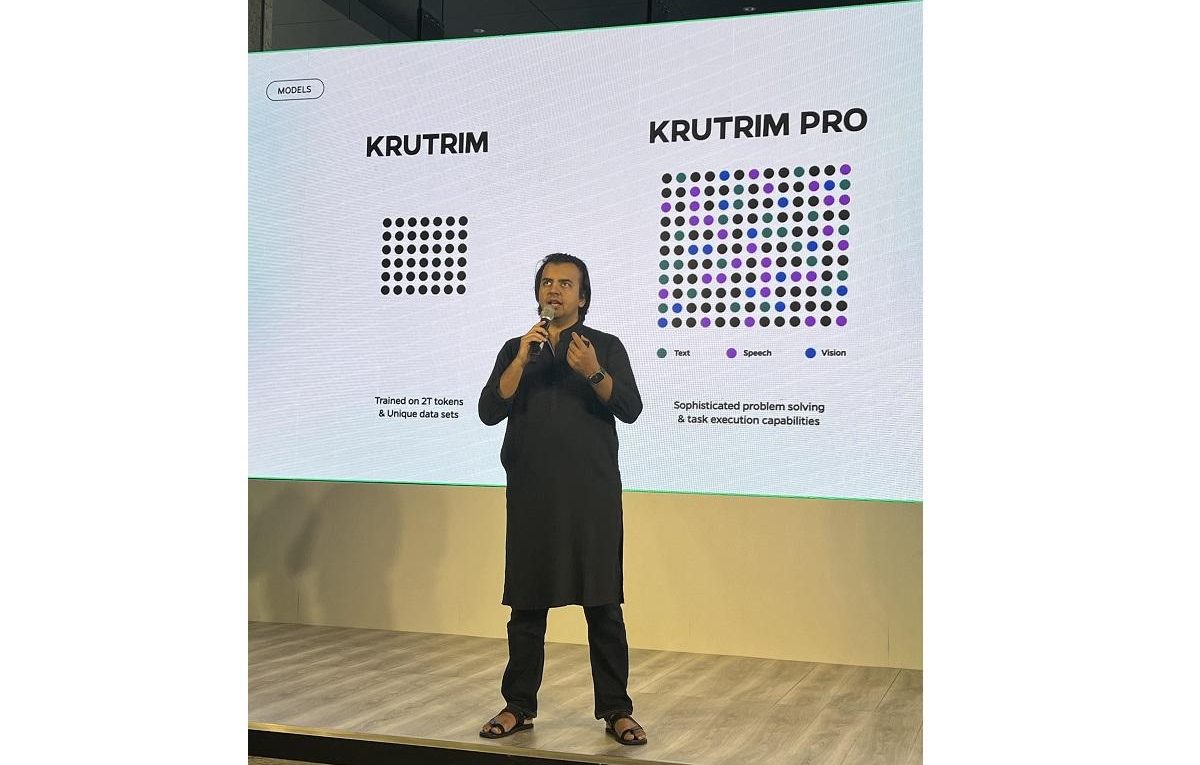

The platform is a family of Large Language Models (LLMs), including Krutrim base and Krutrim Pro, which will have multimodal, larger knowledge capabilities, and many other technical advancements for inference

Krutrim, an artificial intelligence (AI) venture co-founded by Bhavish Aggarwal of Ola, on Friday announced that it has achieved unicorn status — a term used to describe startups valued at $1 billion or above — following its inaugural funding round. The round, which saw participation from notable investors, such as Matrix Partners India, garnered investments worth $50 million in equity at a valuation of $1 billion.

With this, Krutrim claimed the distinction of being India’s first AI company to reach unicorn status and also the title of the country’s fastest unicorn. Krutrim, which translates to “artificial” in Sanskrit, was launched in April 2023 by Aggarwal and Krishnamurthy Venugopala Tenneti, a board member of ANI Technologies that owns Ola and Ola Electric.

The AI startup is the third venture helmed by Aggarwal to achieve a $1 billion valuation, after mobility firm Ola and electric vehicle manufacturer Ola Electric.

The funds raised will be used to expedite the company’s “mission to transform the AI landscape, foster innovation, and extend its global footprint”.

“The funding round not only validates the potential of Krutrim’s innovative AI solutions but also underscores the confidence investors have in our ability to effect meaningful change out of India for the world.”

Matrix Partners India, which led the funding in Krutrim, is an early supporter of Ola Cabs and the IPO-bound Ola Electric. Avnish Bajaj, founder and MD of Matrix Partners India, praised Aggarwal for “consistently bringing cutting-edge tech innovation to India at scale… to power the journey of ‘Viksit Bharat’ digitally.”

In December 2023, Aggarwal unveiled Krutrim’s base Large Language Model (LLM). He has entered the competitive AI race, dominated by players such as Google, Microsoft, and OpenAI. With the largest representation of Indian data used for its training, it powers generative AI applications for all Indian languages.

A team of computer scientists, based in Bengaluru and San Francisco, have trained this model, which will also power Krutrim’s conversational AI assistant that understands and speaks multiple Indian languages fluently, the company said.

The platform’s model, according to the company, can fluently switch between languages and discuss nuanced topics ranging from poetry in Bengali to Bollywood movies and creative masala dosa recipes. Krutrim will be available in the beta version for consumers in February 2024. Additionally, it will also be available as an API (application programming interface) for enterprises and developers, seeking to create AI applications. The company is also working on AI infrastructure to develop indigenous data centers and eventually, server-computing, edge-computing, and super-computers.

Krutrim’s funding comes at a time when Indian generative AI startup Sarvam AI recently unveiled OpenHathi, the first Hindi large language model. Sarvam recently raised $41 million in a Series A round led by Lightspeed and supported by Peak XV Partners and Khosla Ventures. Sarvam is developing a “full-stack” product that can be used for training custom AI models or as an enterprise-grade platform. The company said a full-stack approach will accelerate GenAI adoption in India, given that enterprises acknowledge the technology’s potential but are grappling with how to leverage it for business.

Last month, Aggarwal’s Ola Electric filed a draft red herring prospectus (DRHP) with the Securities and Exchange Board of India (Sebi). In July 2019, the EV manufacturer, then just two years old, raised $250 million from SoftBank and became a unicorn. It now boasts a valuation of $5.4 billion and has raised a total of $998 million, according to analytics firm Tracxn.

Earlier this week, Aggarwal’s Ola announced that its India mobility business turned Ebitda (earnings before interest, taxes, depreciation, and amortization) positive in FY23, making it one of the few Indian internet companies to achieve this milestone. For the consolidated entity, the revenue from operations and other income for FY23 stood at Rs 3,000 crore, up from Rs 2,120 crore in FY22. The Ebitda loss for the consolidated entity, excluding discontinued business, eased to Rs 29 crore in FY23 from Rs 291 crore in FY22.

Ola turned a unicorn in 2015. Until last year, it had a valuation of $4.8 billion, according to Tracxn.

First Published: Jan 26 2024 | 6:00 PM IST