Banking channels used for unauthorised FX trading platforms: RBI Governor Das

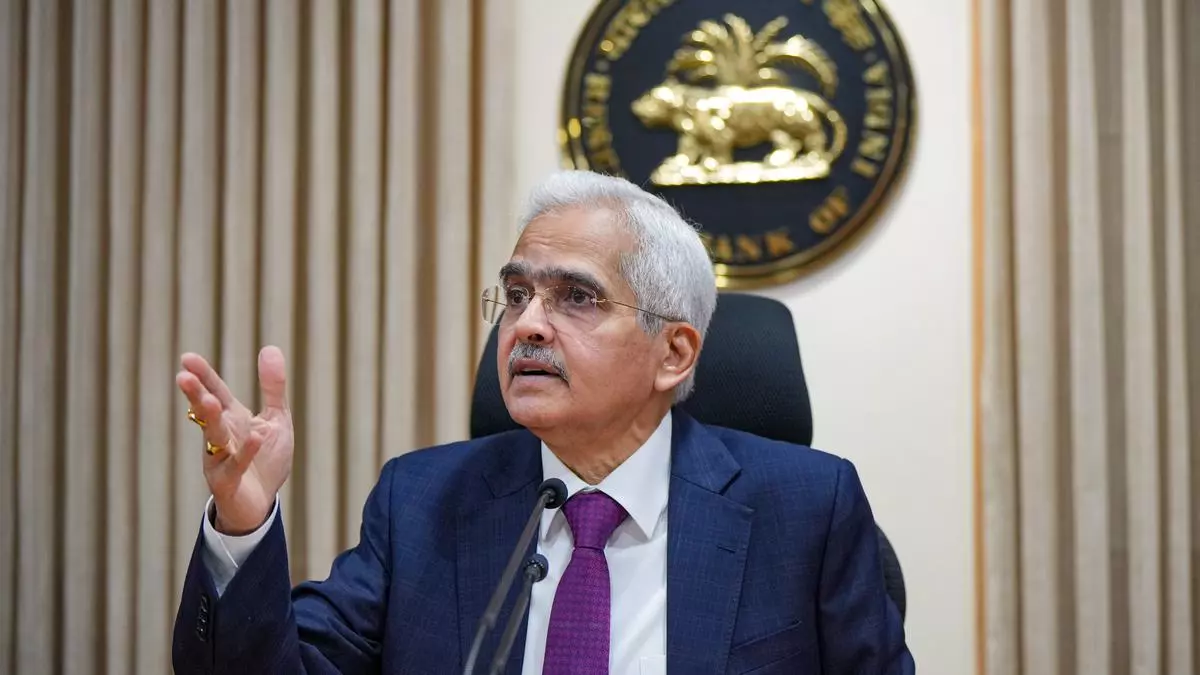

Reserve Bank of India Governor Shaktikanta Das

| Photo Credit:

SHASHANK PARADE

Continued use of banking channels by certain persons or entities to fund activities on unauthorised foreign exchange trading platforms warrants enhanced vigilance by the banks, according to RBI Governor Shaktikanta Das.

The Governor, in his address at the FIMMDA-PDAI Annual Conference, Barcelona on Monday, said considering the complaints of cheating and fraud by unauthorised trading platforms, necessary cautionary advice has been issued against undertaking forex transactions on such platforms.

Alert list

An ‘Alert List’ of entities offering or promoting unauthorised forex trading facilities has also been issued.

Das underscored that appropriate safeguards should be put in place to address the new challenges posed by new products, participants and markets.

For example, as sophisticated OTC derivative products are introduced, they must be accompanied by adoption of certain safeguards, both by the market-makers and customers.

“As our markets get integrated with global markets and non-resident participation increases, transmission channels from global developments will become stronger and speedier.

“This will require greater watchfulness and proactive management of the associated risks by market participants even as the opportunities are grabbed,” he said.

Das observed that transparency in pricing remains work in progress and more can be done.

“The retail customer is yet to get a deal at par with large customers. There is a need for effective market-making and finer pricing for smaller deals on NDS-OM (negotiated dealing system – order matching).

“Divergence in pricing in FX markets for the small and large customers are wider than what can be justified by operational considerations. Banks may need to do more to facilitate the use of the FX Retail platform,” he said.

Derivatives market

The Governor said that participation of domestic banks in derivatives market remains limited with only a small set of active market-makers. Participation of Indian banks in global markets is growing but it is quite small.

“Domestic banks are dealing with market-makers in global markets rather than with end clients and are yet to emerge as market-makers of note globally. Of course, banks need to do their own due diligence, assess their risk appetite, and then move forward carefully in this direction.

“Going forward, our focus should be on enhancing and widening the participation of Indian players in markets for INR (Indian Rupee) derivatives, both domestically and offshore, while being prudent,” he said.

Das observed that liquidity in OTC (over-the-counter) derivatives markets, especially interest rate derivatives, remains confined to a few products, constraining efficient hedging by the larger economy.

Credit derivatives

“The market for credit derivatives which is an important enabler for the lower rated corporate bonds is yet to take off. I am, however, happy to note that the first credit default swap (CDS) transaction after the issuance of the revised guidelines came into effect in May 2022 was undertaken last week.

“In many ways, all domestic market participants are yet to fully embrace the new regulatory framework and exploit the opportunities it presents,” he said.

Das said that efforts are being made to leverage technology for achieving greater efficiency while also meeting the objectives of market reforms.

For example, RBI is exploring the use of technological platforms to expand the reach of financial markets, in particular the reach of the RBI Retail Direct and FX Retail.

E-trading platform

In the derivative markets, efforts are underway to introduce electronic trading platforms for a larger number of derivative products and to expand the central clearing of products.

“To foster greater efficiency, Application Programming Interfaces (APIs) for reporting trades to NDS-OM and accessing the Request for Quote (RFQ) dealing mode are being contemplated.

“Introduction of bond forwards is being considered to enable long-term investors to manage their interest rate risks efficiently – draft guidelines in this regard were issued in December 2023,” the Governor said.

The central bank remains engaged with stakeholders to assess the need for the introduction of new products and infrastructure based on evolving market developments.

Das emphasised that bank treasuries need to scale up their dynamism to utilise the opportunities presented in the context of the recent regulatory reforms.

“This is very critical for achieving efficient market intermediation, effective management of financial risks and alignment of financial variables across different segments and markets. From this financial year (2024-25), the new prudential framework for investment by banks has come into effect.

“The new regulations provide increased flexibility to banks in managing their treasuries and offer scope for increased efficiency, provided banks manage their treasury function actively,” the Governor said.

The framework of assessment of a bank’s treasury should take into account risks arising out of action and risks arising out of inaction – missed opportunities, he added.

“Going forward, our focus should be on enhancing and widening the participation of Indian players in markets for INR derivatives, both domestically and offshore, while being prudent.” Shaktikanta DasGovernor, RBI