Aditya Birla Finance to merge with parent in 12 months

The board of Aditya Birla Capital on Monday announced the merger of wholly-owned subsidiary Aditya Birla Finance with itself to create a large unified operating NBFC, with the merger expected to be completed in 9-12 months.

The merger is being proposed to consolidate the business and number of entities, rationalise and simplify the Group structure, improve financial stability, pool the knowledge and expertise of both parties, align their business plans, enhance stakeholder value, increase operational efficiency, the company notified the exchanges.

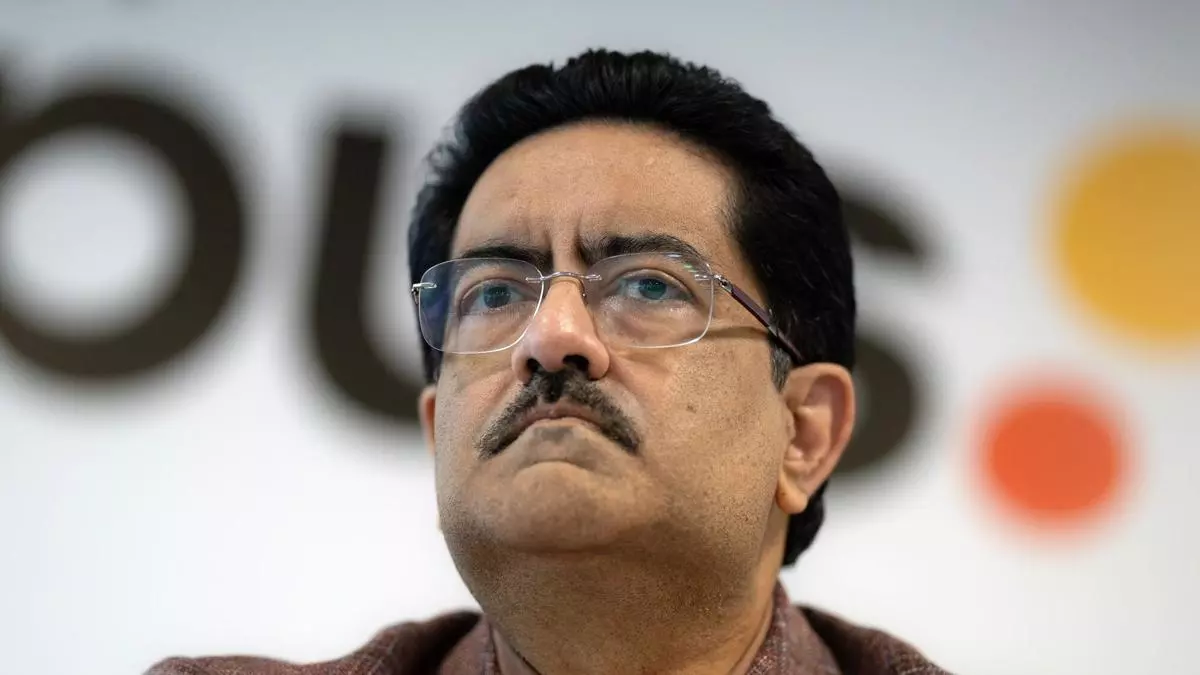

“Our financial services business has scaled smartly to emerge as a core growth engine for the Aditya Birla Group. The proposed amalgamation will create a strong capital base for Aditya Birla Capital to grow its business,” said Kumar Mangalam Birla, Chairman, Aditya Birla Group.

Scale-based regulations

The plan for amalgamation is also in-line with RBI’s scale-based regulations, which required Aditya Birla Finance to be listed by September 30, 2025. The amalgamation is subject to regulatory and other approvals from NCLT, RBI, stock exchanges, SEBI, shareholders and creditors.

Aditya Birla Capital is a listed systemically important non-deposit taking core investment company (NBFC-CIC), and has been classified as a Middle Layer NBFC (NBFC-ML) under the Scale-Based Regulations. Aditya Birla Finance is a non-deposit taking systemically important NBFC (NBFC-ICC), classified as an Upper Layer NBFC (NBFC-UL). It offers end-to-end lending, financing and distribution of financial products, including mutual funds and insurance.

The merged entity, on pro forma basis, is expected to have lending assets worth Rs 1.1 lakh crore and its CRAR is expected to improve by 150 bps.

Post amalgamation, Aditya Birla Capital will get converted from a holding company to an operating NBFC. It’s equity investment in Aditya Birla Finance will be cancelled. There will no change in the shareholding, management and control of the parent company, which will continue to hold existing investments in subsidiaries and associates.

“This will create a unified large entity with greater financial strength and flexibility enabling direct access to capital. This will also help the Company to maximise opportunities by efficient utilisation and allocation of capital,” it said adding that the proposed amalgamation is tax neutral for both entities.

Business verticals

The proposed merger will also enable operational synergies and lead to expansion and

long-term sustainable growth through seamless implementation of policy changes and reduction in the multiplicity of legal and regulatory compliances.

The merged entity will be engaged into the lending business (NBFC business of Aditya Birla Finance and housing finance business through its subsidiary), and various non-lending financial services and ancillary businesses, directly and indirectly, through subsidiaries and associates.

Other than Aditya Birla Finance, Aditya Birla Capital’s subsidiaries include wholly-owned arms Aditya Birla Housing Finance and Aditya Birla ARC. Aditya Birla Sun Life Insurance, Aditya Birla Health Insurance, Aditya Birla AMC and Aditya Birla Insurance Brokers are subsidiaries where the company has 46-51 per cent shareholding, and Aditya Birla Money where it hold 74 per cent stake.

“At Aditya Birla Capital, we follow a ‘One ABC, One P&L’ approach and are committed to drive quality and profitable growth by harnessing the power of data, digital and technology,” said Aditya Birla Capital CEO Vishakha Mulye, adding that the merger will also help the NBFC serve its customers better.

Following the merger, Mulye will assume the role of MD and CEO, and Aditya Birla Finance CEO Rakesh Singh will be appointed Executive Director and CEO (NBFC).

As of December 2023, Aditya Birla Capital had an aggregate AUM of Rs. 4.1 lakh crore and a lending AUM of Rs 1.15 lakh crore. Gross written premium under the life and health insurance business was Rs 13,500 crore.