Buffers are best built up during tranquil and good times: Guv to regulated entities

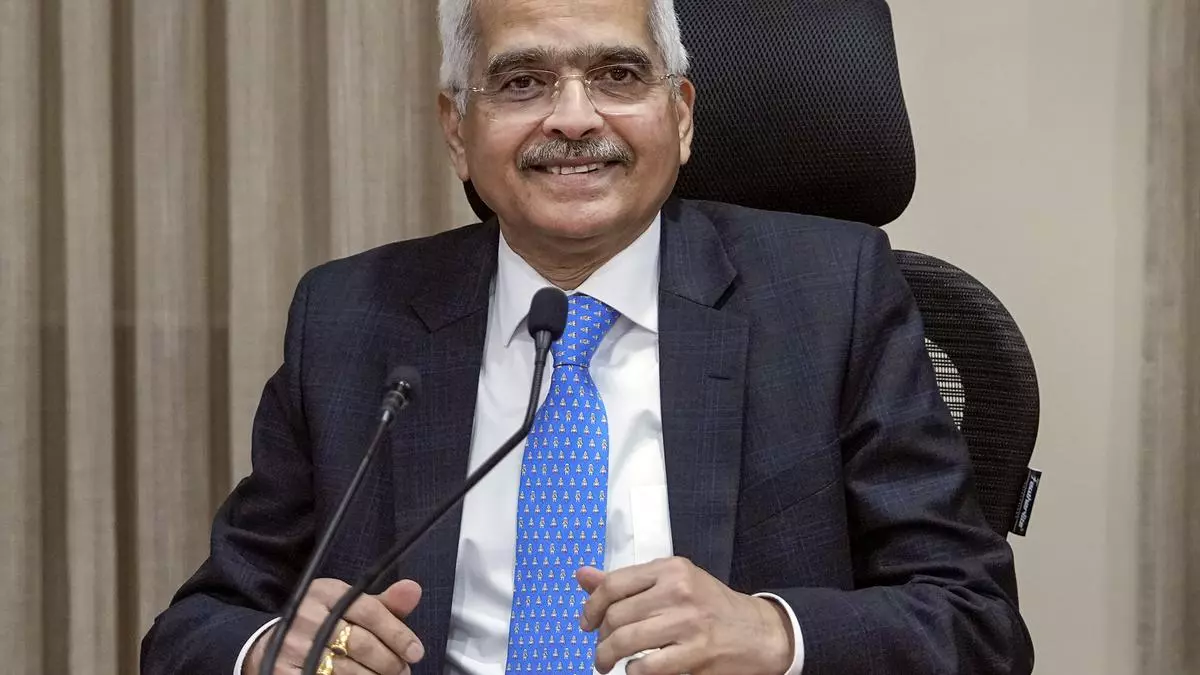

Reserve Bank of India Governor Shaktikanta Das, on Thursday, impressed upon regulated entities that buffers are best built up during tranquil and good times.

He observed that the Indian financial sector has been stable and resilient, as reflected in sustained growth in bank credit, low levels of non-performing assets and adequate capital and liquidity buffers.

“Macro stress tests for credit risk reveal that scheduled commercial banks (SCBs) would be able to comply with the minimum capital requirements even under severe stress scenarios.

“There is, however, no room for complacency because it is during tranquil and good times that vulnerabilities may creep in. Hence, buffers are best built up during these periods,” Das said.

He noted that a stable financial system is a prerequisite for price stability and sustained growth.

“This is a shared responsibility in which regulated entities like banks, NBFCs and others are important stakeholders.

“On its part, the Reserve Bank remains steadfast in its commitment to safeguard the financial system from the emerging and potential challenges. We expect the same from the regulated entities also,” the Governor said.