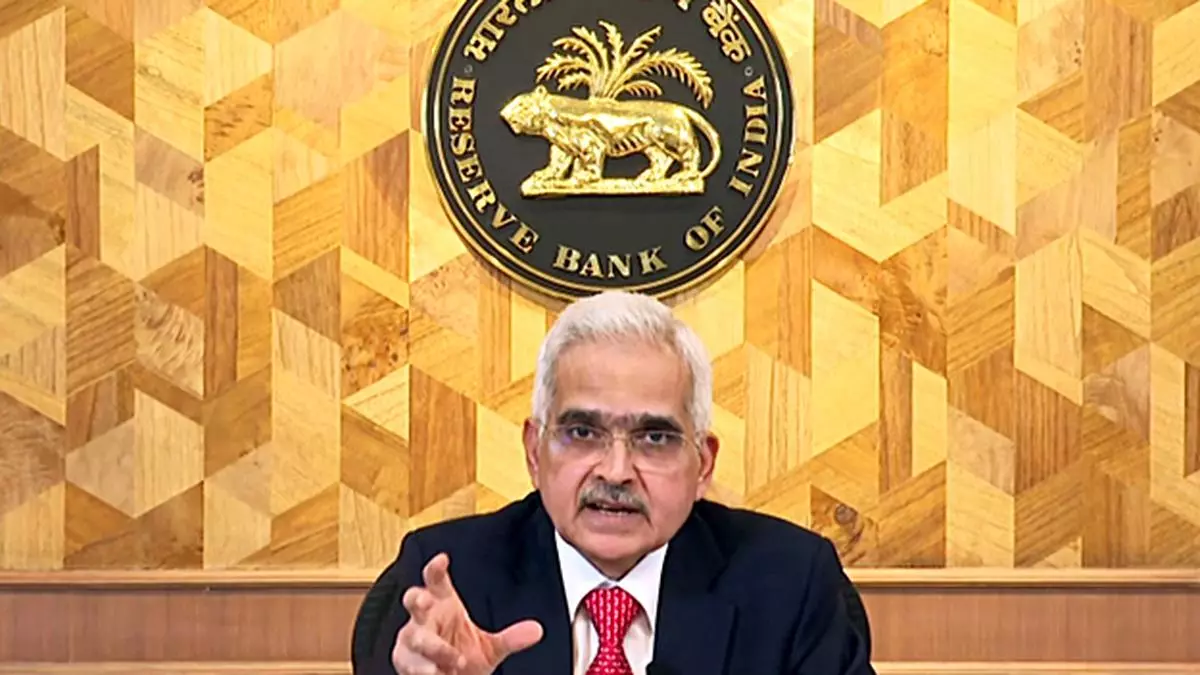

RBI holds key rate ‘to bring down inflation in the interest of growth’

The six-member monetary policy committee (MPC) on Friday stood its ground, maintaining the status quo on the policy repo rate amid mounting calls from various quarters, including cabinet ministers, to usher in a softer interest rate regime.

RBI Governor Shaktikanta Das emphasised that (retail) inflation, which crossed the MPC’s upper tolerance level of 6 per cent in October 2024, has to be brought down in the interest of sustainable growth. He emphasised that the credibility of the flexible inflation targetting framework needs to be preserved.

The RBI lowered its FY25 real GDP growth projection to 6.6 per cent (from the earlier projection of 7.2 per cent) even as it upped its retail inflation projection to 4.8 per cent (4.5 per cent).

- Also read: RBI MPC Meeting 2024 Highlights

Even as the repo rate was left unchanged, RBI announced a 50 basis points cut in the cash reserve ratio to 4 per cent with a view to ease the potential liquidity tightness that could arise in the coming months due to tax outflows, increase in currency in circulation and volatility in capital flows. This reduction will release primary liquidity of about ₹ 1.16 lakh crore to the banking system.

Further, to attract capital more capital inflows, the central bank increased the interest rate ceilings on Foreign Currency (Non-resident) Accounts (Banks)/ FCNR (B) deposits for a limited period up to March 2025.

The repo rate was left unchanged by MPC at 6.50 per cent by a majority of 4:2 (5:1 majority in the October bi-monthly monetary policy meeting) in the backdrop of retail inflation running well above its 4 per cent target (at 6.2 per cent in October, a 14-month high), the second quarter growth slowing to a two-year low of 5.4 per cent, and a depreciating currency.

The MPC also decided unanimously to continue with the ‘neutral’ stance and to remain unambiguously focused on a durable alignment of inflation with the (4 per cent) target, while supporting growth.

The Committee has been on hold since February 2023, when it raised the repo rate from 6.25 per cent to 6.50 per cent.

It may be pertinent to mention here that last month, Das observed that a change in stance (from the withdrawal of accommodation to neutral made in the October 2024 bi-monthly policy review) doesn’t mean that the next step is a rate cut in the very next meeting.

Madan Sabnavis, Chief Economist, Bank of Baroda, said that given the more benign forecast of 4.5 per cent CPI inflation for the fourth quarter, there is a good chance of a reduction in repo rate in the next policy.

Das emphasises FIT framework

In the backdrop of expectations of a rate cut due to a slowdown in the second quarter GDP growth, the Governor underscored that the MPC’s effort is to follow the flexible inflation targeting (FIT) framework as provided in the RBI Act. The Act provides that the RBI – that is the MPC – is mandated to maintain price stability, keeping in mind the objective of growth.

“Persistent high inflation reduces the purchasing power of consumers and adversely affects both consumption and investment demand. The overall implication of these factors for growth is negative.

“Therefore, price stability is essential for sustained growth. On the other hand, a growth slowdown – if it lingers beyond a point – may need policy support,” he said.

Das highlighted that as provided in the law, it is always the effort of the RBI and MPC to follow the position of the law as embedded in the RBI Act in letter and spirit.

Need to restore balance between inflation and growth

The Governor observed that the MPC remains committed to restoring the balance between inflation and growth, which has got unsettled recently. Moreover, the RBI will use its various policy instruments to create the conditions for restoring the inflation-growth balance.

“Since the last policy, inflation has been on the upside, while there has been a moderation in growth. Accordingly, the MPC has adopted a prudent and cautious approach in this meeting to wait for better visibility on the growth and inflation outlook.

“At such a critical juncture, prudence, practicality and timing will continue to be the guiding principles for the RBI’s future actions. It is all about the dissection of the inflation-growth conditions and acting accordingly. Timing of actions is the key,” Das said.

MV Rao, Chairman of the Indian Banks’ Association, and MD & CEO of the Central Bank of India, said the monetary policy measures are expected to aid growth by providing more resources to the banking system to deploy without deviating from the core objective of controlling inflation.