Beauty retailers report high demand for prestige and premium segments | Start Ups – Business Standard

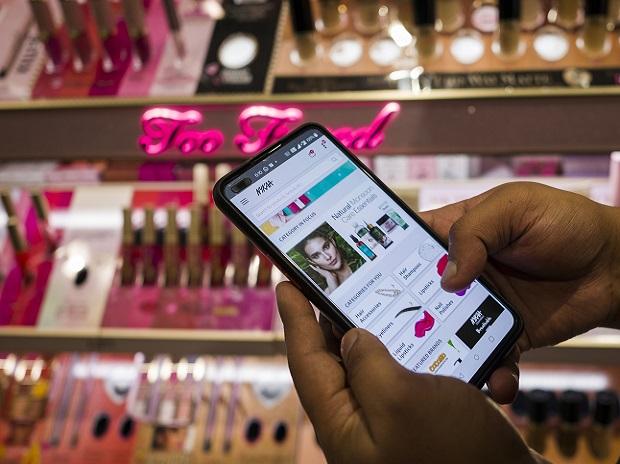

The Nykaa application for online purchases | Bloomberg

In the Indian market, beauty now lies firmly in the eyes of the premium consumer.

With the rapidly evolving Indian consumer market giving an impetus to luxury segments, the beauty market, too, is witnessing a similar trend.

As disposable incomes rise and more women continue to join the workforce, beauty retailers are seeing an upward movement in the prestige and premium segments. The market has also grown quickly on the back of deeper e-commerce penetration and online payments systems.

“The prestige beauty segment of our business is growing at about a 50 per cent CAGR (compound annual growth rate) over the past three years and about a third of our GMV (gross merchandise value) comes from what we define as premium and prestige beauty brands,” said Anchit Nayar, executive director and chief executive officer (CEO), Nykaa Beauty, in a call with investors after announcing the company’s third quarter results.

The platform, which has over 85 premium beauty brands in its physical retail stores, said 65 per cent of its share of the GMV from retail stores comes from premium prestige brands.

During its flagship Pink Friday sale in November, the company witnessed 32 per cent growth for premium brands in terms of GMV in 2023 as compared to 2022, Nayar had said.

According to a September 2023 report by Redseer Strategy and Peak XV, the Indian beauty and personal care market has the highest growth rate among comparable nations. Driven by consumers’ willingness to pay more for products that address specific needs and their trade-up to masstige and prestige products, the market is forecasted to reach $30 billion by 2027.

Masstige brands are part of the mass-market segment given their price positioning and availability but include a “prestige feel”.

“The growth of the masstige and premium segments is even more pronounced in India, where they are growing two times as fast as the mass market segment,” said the report.

As the appetite for prestige and masstige grows in India, retailers are increasingly looking at launching new brands.

For instance, Shoppers Stop expanded its distribution tie-up (Global SS Beauty) with Japan-based Shiseido Group last year and launched its cosmetic line NARS in October.

“At Shoppers Stop, the beauty category is growing at 18 per cent — outpacing the company’s growth of 9 per cent. Out of this, the prestige beauty market is moving at a faster pace,” Biju Kassim, customer care associate and CEO of beauty, Shoppers Stop, told Business Standard earlier this month.

For Shoppers Stop, the prestige segment accounts for 50 per cent of the beauty business, of which fragrance and make-up forms 40-42 per cent, while skincare contributes the remaining.

The company, which has a strong global portfolio, will soon stack its shelves with beauty lines from luxury brands such as Prada, Armani and Valentino.

Reliance’s beauty platform Tira, too, has witnessed a significant surge in sales of luxury products such as premium skincare, fragrances, make-up and beauty appliances.

“This is due to the rise in the number of beauty enthusiasts, beauty influencers, innovation and technological advancements in product formulations,” said a spokesperson for the company.

To meet the burgeoning demand, Tira has included several brands — with Allies of Skin being the latest and exclusive addition. “Other luxury brands like Maison Margiela, Laura Mercier, Farmacy, and Sulwhasoo further enrich Tira’s premium portfolio,” the spokesperson added.

L’Oréal, one of the world’s largest cosmetics companies, is also eyeing a bigger pie.

“The premium market is seeing 20 per cent growth on the back of new formats like face and hair serums, sheet masks, mascara, concealers, and primers,” said Pankaj Sharma, director, consumer products division, L’Oréal India.

Sources said the company was set to bring YSL Beauty to India. However, the company declined to comment.

In the last two years, L’Oréal has launched innovations based on ingredients across its portfolio for discerning consumers looking for superior quality, innovative formulae, and high sensorial experiences.

According to the Redseer report, both L’Oréal and Shiseido have seen an increase in revenues from the prestige segment. While the revenue share from Shiseido’s prestige category grew from 40 per cent in 2016 to 60 per cent in 2022, at L’Oréal the revenue contribution from its luxe category grew from 31 per cent in 2016 to 38 per cent in 2022.

As it caters to growing demand, the luxury segment is promising to prioritise sustainability, tap into digitalisation for personalised experiences, emphasise wellness and enhance experiential retail offerings.

First Published: Feb 29 2024 | 10:01 PM IST