Ola Electric posts Rs 2,782 cr revenue in FY23, says losses reduced to 43%

IPO-bound Ola Electric Mobility Business said that it has registered strong growth as the total revenue has gone up by 510 per cent to Rs 2,782 crore in the financial year (FY) 2023 from Rs 456 crore in FY 2022. Total revenue includes revenue from operations and other income. The EBITDA profit/(loss) for FY 2023 has improved from (157 per cent) in FY 2022 to (43 per cent) in FY 2023. However, the SoftBank-backed company didn’t reveal the loss number.

But Ola Electric’s net loss reportedly doubled to about Rs 1,472 crore in FY 2023 from Rs 784.1 crore in the previous fiscal year, as expenses surged significantly, according to the media reports. The company reported an EBITDA loss of Rs 1,318 crore as its total expenses jumped to Rs 3,383 crore, in comparison to Rs 1,240 crore in FY 2022.

The Bhavish Aggarwal-led company said that it has set in motion a few initiatives for strong growth and profitability in the near future.

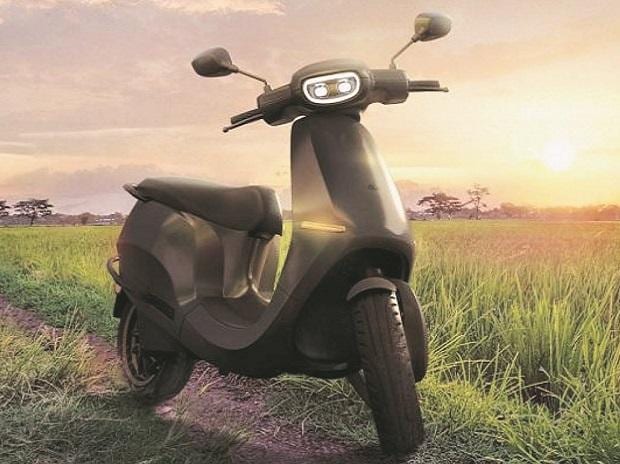

This includes a new product portfolio. Ola recently expanded its S1 portfolio to five scooters with its Generation 2 platform. The company currently sells S1 Pro (2nd Generation), S1 Air, and S1 X in three variants – S1 X+, S1 X (3kWh), and S1 X (2kWh).

The other focus is on sales and service network expansion. The company has expanded its D2C (direct-to-consumer) omnichannel distribution network in FY 2023. As of 31 October CY 2023, the company has 935 experience centres and 392 service centres.

Ola is also strengthening its research and development operations. It has operationalized and strengthened R&D facilities in India and the UK, focused on designing and developing core EV components and new EV products. Ola also commenced operation at their Battery Innovation Center (BIC) in Bengaluru, in August 2023, that is focused on developing cell and battery technology and manufacturing processes for their forthcoming cell manufacturing operations at the Ola Gigafactory.

Ola Electric in November had the highest monthly registrations (30,000) for its electric scooters, helped by strong festive demand. The company cited the state-run VAHAN portal to say it had a month-over-month growth of 30 per cent in registrations and year-over-year growth of 82 per cent. The company said it dominated the electric scooter market with a 35 per cent share in November. The firm competes with Ather Energy, Okinawa Autotech, Ampere EV by Greaves, Hero Electric, and TVS Motor Company.

Ola Electric has transformed itself into a public company as it gears up for its Initial Public Offering (IPO) in the next few weeks. This involves undertaking a corporate restructuring that will convert it into a public company, regulatory filings showed. The IPO may be in the range of $800 million to $1 billion, according to the sources. The firm is set to take the first step towards an IPO next week. The company is preparing to file a Draft Red Herring Prospectus (DRHP) with the Securities and Exchange Board of India (SEBI) before 20 December 2023, according to the sources.

The company recently secured about Rs 3,200 crore in funding as part of its equity and debt round. This funding was obtained from Temasek-led marquee investors and project debt from State Bank of India. The funding round, which includes equity, has raised the Bengaluru-based firm’s valuation to $5.5 billion, up from its previous valuation of $5 billion, according to sources.

The raised funds are being utilised to expand Ola’s electric vehicle (EV) business and establish India’s first lithium-ion (Li-ion) cell manufacturing facility in Krishnagiri (Tamil Nadu). These funds will also enable Ola Electric to accelerate the growth of its two-wheeler manufacturing capacity and facilitate the launch of electric motorcycles, followed by electric cars, and expedite the construction of the Gigafactory.

Ola Electric was selected by the government as the only Indian EV company under its ambitious Production-Linked Incentive (PLI)-Advanced Chemistry Cell (ACC) Scheme, receiving a maximum capacity of 20 gigawatt-hour (GWh). The PLI-ACC Scheme will be instrumental in localising the most critical aspects of the EV value chain.